Fintech has actually improved different frameworks and services within the financial realm.

When aiming to greater comprehend the value and applications of fintech, it is necessary to consider the various varieties of it utilised today. Arguably, among the most generally utilised forms of fintech is digital payment apps. Essentially, these apps help businesses provide their customers quickly and obtainable transactions. By just logging onto a secure application on a cellphone, people can quickly access their finances and make payments digitally. Another invaluable application within the financial realm would certainly be Personal Financial Management (PFM) apps. Basically, these apps have access to a broad array of financial information, resources and platforms, which can help customers handle and comprehend their financial click here situation. Individuals acquainted with the UK fintech realm would specify that PFM apps are generally utilised to help people budget and monitor their expenses. Insurtech is another instance of fintech used today and describes the technology which support financial and insurance processes. The primary function of this technology is to modernise preexisting insurance frameworks to boost the customer experience and expenses connected to them. Another advantageous facet of this technology would certainly be its capacity to find fraudulence and risks, in addition to promote openness.

Like lots of other technologies used today, fintech is changing due to innovation and changes in demand. By having a look at the arising trends in this field, individuals can obtain a greater idea of how it is progressing over time. A popular fintech trend worldwide would certainly be the implementation of blockchain technology, which is designed to promote safe and secure and transparent transactions. Another noteworthy trend within this field would certainly be RegTech. People that work within the Singapore fintech field would certainly recognise that this technology helps financial institutions and businesses better comply with policies. Through its capability to automatically collect data, as well as identify and report risks, businesses can a lot more considerably safeguard their frameworks and customers.

Within the last couple of years, numerous technologies have actually sustained the function of contemporary society. Taking this into account, it could be argued that one of the most significant technologies today is financial technology. This specific technology is generally described as fintech and is the technology designed to improve financial services and processes. The importance of fintech is highlighted via its capability to enhance the accessibility of financial solutions and services. For the most part, typical financial services can be very tough to access. This is due to the fact that individuals are required to physically access physical structures to manage their finances and acquire support. Via fintech, people and firms can now conveniently access their finances and acquire support through digital means. As seen within the Malta fintech sector, this technology has actually been shown to boost the effectiveness of financial frameworks by minimising costs and hold-ups within the field. Fintech has actually come to be a crucial technology for those looking for personalised financial services. With the employment of artificial intelligence and data gathering processes, fintech can help customers fulfill their financial requirements and goals effortlessly.

Jake Lloyd Then & Now!

Jake Lloyd Then & Now! Mason Gamble Then & Now!

Mason Gamble Then & Now! Danny Pintauro Then & Now!

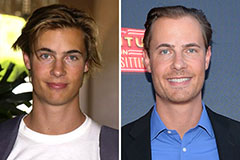

Danny Pintauro Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Suri Cruise Then & Now!

Suri Cruise Then & Now!